The complete flush out after the horrible Q1 earnings, with bad Q2 guidance was brutal. From slowing double digit growth to basically next to no growth, to also margins compressing faster than expected will obviously be punished by the market no matter what. — Let’s assess the situation.

The two main underlying issues here are:

Ring fencing in Europe, which was totally unexpected, and caught everyone off guard. That the UK license issue would lead to a Europe wide withdrawal from unregulated sites without any domestic licenses was surprising.

Longer than expected headwinds from Asian “Cyberattacks”, this refers to bad actors illegally distributing or re-streaming the software to use it while circumventing the Evolution profit cut, which is going on for some quarters now.

For me personally Evolution was a fairly recent and small position, around 8% of my portfolio, nonetheless the recent drawdown ate into my margin of safety quite a bit, I was in the green on the position before earnings.

While my portfolio is currently still outperforming the S&P 500 by double digits YTD, this hurts regardless lol.

Ring Fencing

The situation here is that local governments aren’t able to punish offshore gambling sites who allow UK citizens to play on their sites to name an example. What governments will then do is target providers, who legally operate in domestic countries with local licenses.

We’ve seen such a crackdown from the Michigan Gaming Control Board in the US.

Kurt Steinkamp, chief of staff of the Michigan Gaming Control Board, was working with the attorney general’s office on prosecutions of offshore operators who target US players.

His comments on the matter:

“Certainly, we would be taking a look at the »SUPPLY BASE« of the offshore operators within the United States.”

“We do have substantial legal authority to go after individuals who are aiding in illegal activity.”

He adds:

“We will be considering legal actions against U.S.-based businesses who are partnered with offshore operators and aiding their operations. That may include payment processors, affiliate marketers and advertisers.”

Without any concrete knowledge on the situation in Europe, one could assume a similar dynamic at play here.

If the sudden cutoff of unregulated sites was due to pressure from regulators or a preemptive measure by Evolution is almost secondary at this point. — This transition to ideally 100% regulated sites is expected but not that rapidly.

Investors assumed revenue share development similar to the big tobacco stocks, combustible revenue slowing fading, while the modern oral category growths.

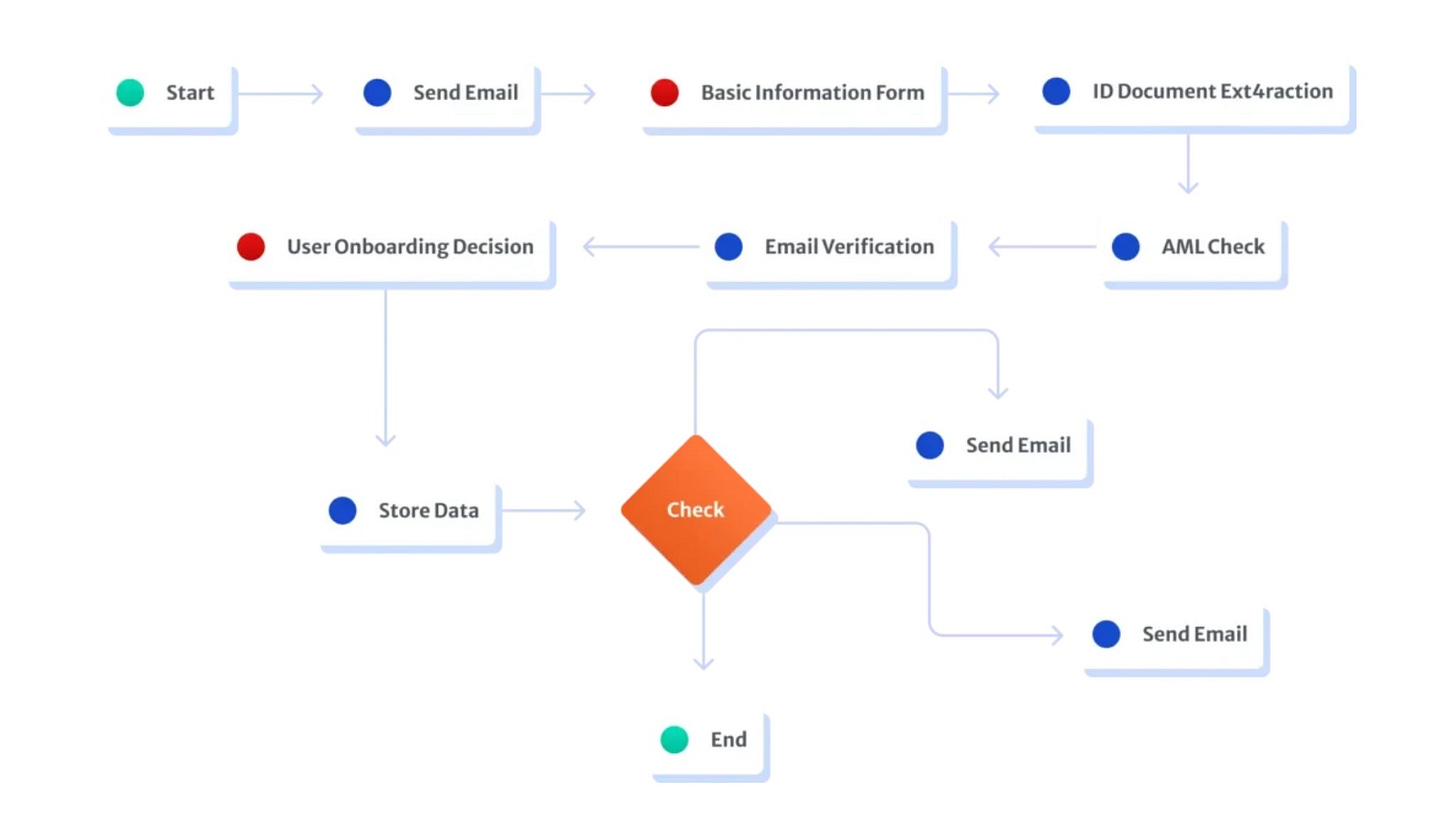

The problem with regulated markets is the standards for onboarding players is way higher, no more non-KYC accounts being bankrolled from obscure bank accounts in the Cayman Islands.

There’s more friction, more limits, more rules etc., which means lower growth, lower margins, higher costs.

Cyberattacks

This issue is more vaguely communicated to shareholders. — While the issue is known and impacting the company for some time, it’s hard to understand what exactly is at play here.

The situation was mentioned as: cyberattacks are likened to digital piracy, such as unauthorized access to live casino streams, similar to pirating movies.

I have seen people suspecting bad motives with such vague communication, while I would raise the issue that communicating on how to scam the company might not be in everyone’s best interest.

I read some articles on the matter, and especially in Southeast Asia (live) video piracy seems to generally be a big phenomenon in the region.

The question is how to resolve this? We know there is no quick fix since this issue is plaquing the Asian operations for a while. I can only guess here:

Changes to the commissions based marketing sales teams

Trial and error pulling integrations from gambling sites in hope to eliminate bad actors

Re-coding to enhance control over the product to prevent any illegal re-streams if possible

Takes time + money, sadly.

The Verdict

It’s a tough situation going from a growth stock to a perceived value stock, at least temporarily. — There is no issue with the underlying business, Evolution’s games are still a must have for gambling site operators, nothing changed here. I would recommend investors to browse through the streaming platform Kick on the Slots & Casino segment, to get a feel for the Evolution brand recognition among players.

The pulling of integrations will hurt the gambling sites as well.

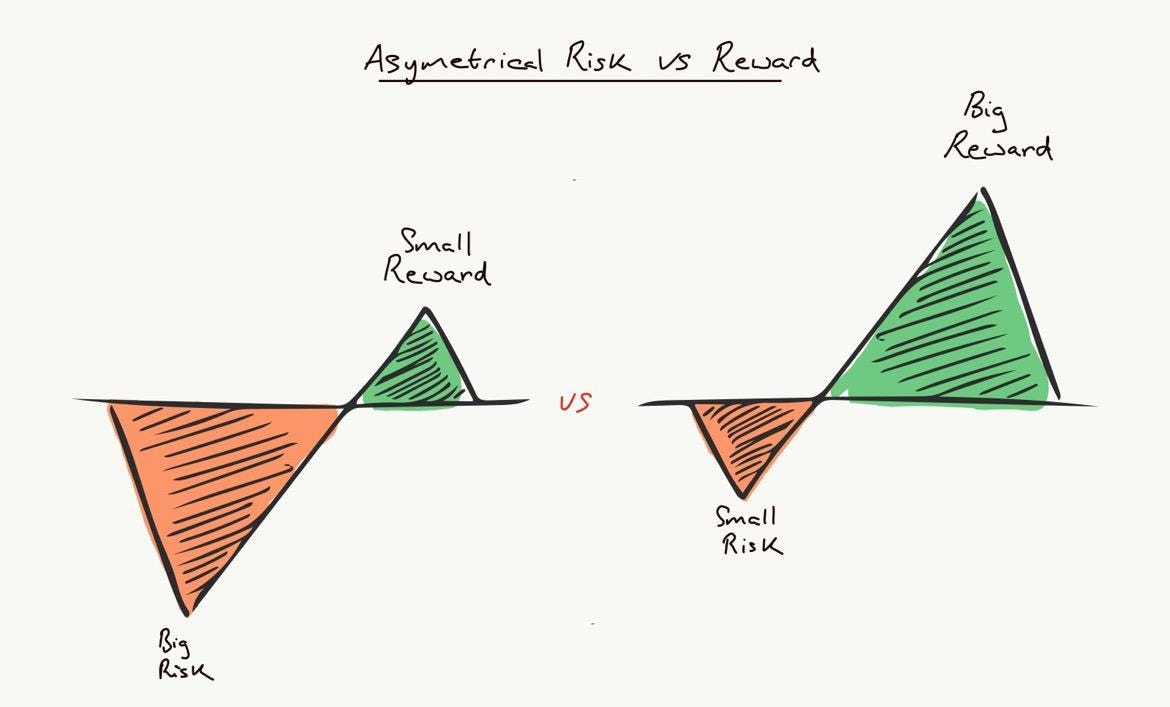

Evolution stills offers an asymmetrical risk-reward scenario here in my opinion, after all the issues are temporary, with management expecting margin stabilizing later this year around 66-68% EBITDA. The investment case is not broken, but the margin of safety unquestionably evaporated.

Lesson To Learn

While I love such businesses being beaten down and suppressed for longer due to pessimistic assumptions that turn out to be only temporary, I see people doing quite a few mistakes with such stocks.

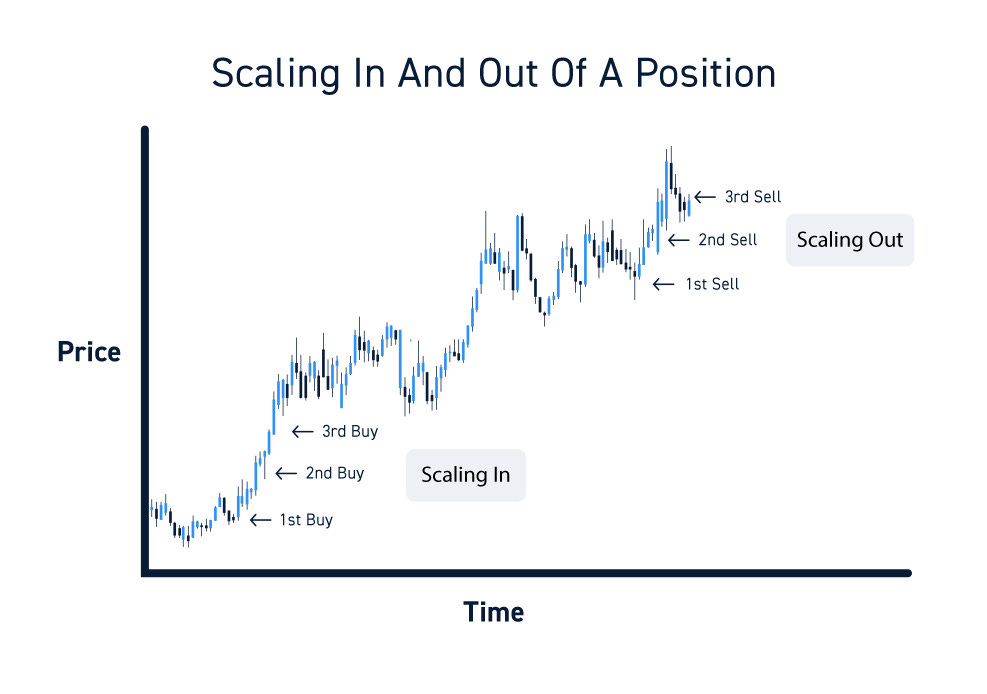

After all it’s still a turn around story in a high risk industry, set proper valuation targets beforehand (especially lower for such an industry) and don’t try to catch a falling knife. I have seen people doubling down multiple times while being down like -60% on this stock.

Druckenmiller’s “Scale In” strategy, while keeping a conservative position size, is key here from my experience.

Seeing people having 100% of their portfolio in this stock and needing +140% to break even on their position is painful to watch. — Don’t be that guy chasing stocks.

I will personally continue to slowly build up this position, it’s a cash machine, with dividends + buybacks already yielding an average market return alone.

It’s just the perfect storm hitting both of Evolution’s bread and butter operations in Europe and Asia simultaneously, growth will eventually pick up again, but it’ll take some time from here.

this was good, i also wrote a piece on evolution. check out my substack if u have time!!!

FWIW margin of safety generally refers to the gap between intrinsic value and price, not between price and entry price.